Our concept on Corporate Governance

We recognize that the realization of our corporate vision "To live in harmony with individuals and society and to put

smiles on people's faces by continuously creating living spaces of comfort and enrichment" will lead to the

sustainable growth of our group and enhance our corporate value over the medium to long term, in line with our

corporate purpose "Supporting People and the Earth through "Seating" Technology'". We believe it is important to work

on improving corporate governance to support this, and we will continuously work on improving corporate governance in

accordance with the following basic principles.

Basic Policy

- We strive to ensure the rights and equality of shareholders and create an environment in which they can exercise

their rights appropriately.

- We strive for appropriate collaboration with stakeholders other than shareholders (customers, employees,

business partners, local communities, etc.).

- We strive to ensure appropriate information disclosure and transparency.

- We strive for appropriate execution of the roles and responsibilities of the Board of Directors, based on its

fiduciary responsibility and accountability to shareholders.

- We strive to engage in constructive dialogue with shareholders.

Basic Policy of Corporate Governance

Corporate Governance Report(July 14,2025)

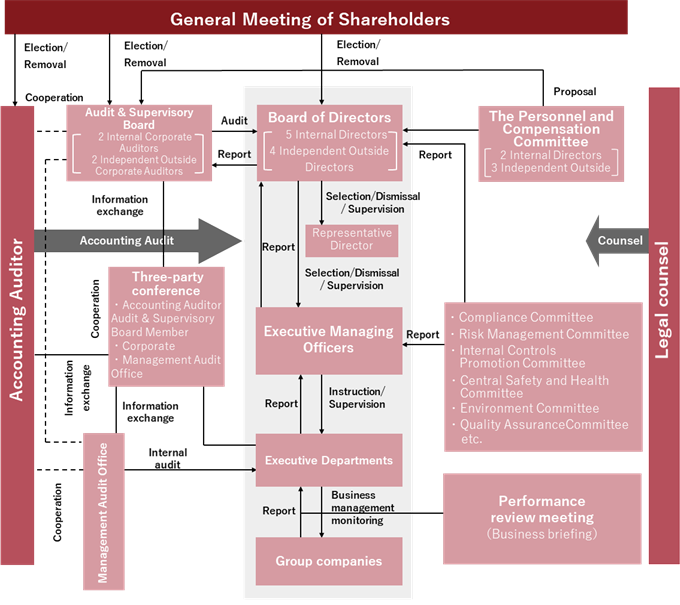

Corporate Governance System

The Board of Directors consists of nine Directors, including four Outside Directors, and the Audit & Supervisory

Board

consists of four Audit & Supervisory Board Members, including two Outside Audit & Supervisory Board Members.

In

addition, we have set the term of office for Directors to one year and introduced the Executive Managing Officer

system to clarify management responsibility and improve management efficiency. We have established a system to monitor

management from an objective and professional perspective, and appointed four Outside Directors (one lawyer, one

certified public accountant, and two corporate executives) and two Outside Audit & Supervisory Board Members (one

lawyer and one certified public accountant) who are unbiased toward the interests of the Company’s management or

specific stakeholders.

From June 2023, the Chairman of the Board of Directors will be an independent outside director, and one of the four

outside directors is a female director. And we are expanding the transparency and diversity of the Board of Directors.

Board of Directors

The Board of Directors meets once a month in principle, and consists of nine members, including four Outside

Directors.

The Board makes decisions and reports on important management matters, including statutory matters, and supervises

business execution.

An independent outside director has become the chairman of the Board of Directors since June,2023.

Executive Managing Officers

In order to efficiently promote business execution, we hold the Executive Managing Officers consisting of Executive

Managing Officers, including those who also serve as Directors, twice a month in principle.

It decides on important matters other than those to be resolved by the Board of Directors, and reports on important

matters to the Board of Directors.

Audit & Supervisory Board

The Audit & Supervisory Board consist of four members, including two Outside Audit & Supervisory Board Members

(one

lawyer and one certified public accountant), and they meet thirteen times a year in accordance with the audit

plan. Audit & Supervisory Board Members audit the execution of duties by the Directors and the status of business

and

assets of the Company and its subsidiaries by attending important meetings and conducting various investigations in

accordance with the audit policy, division of duties, etc., as determined by the Audit & Supervisory Board . In

addition, in order to supplement the Audit & Supervisory Board and to share information among the Audit &

Supervisory

Board Members, meetings of the Audit & Supervisory Board Members are held in conjunction with the Audit &

Supervisory

Board.

Personnel and Compensation Committee

The Company has Audit & Supervisory Board, but has established a Personnel and Compensation Committee as a

voluntary

committee to supplement the functions of the Board of Directors. The Committee deliberates on matters related to

employees and compensation of officers and other personnel and is responsible for proposing the results of its

deliberations to the Board of Directors. The Company held eight meetings of Personnel and Compensation Committee in

FY2023. The committee consists of five or more directors (three are independent outside directors* and two are

internal directors), and from June 2023, independent outside directors will serve as chairpersons of the Personnel and

Compensation Committee, and one corporate auditor will be an observer. It is a system in which you can attend and

express your opinions. By establishing this Committee, we aim to further strengthen corporate governance by ensuring

objectivity and transparency in employees and compensation of officers and other personnel.

(Note) An Outside Director or Outside Audit & Supervisory Board Member is a person who meet the

"Criteria for Assessing Independence of Outside Directors/Audit & Supervisory Board Members" described below.

Number of meetings of the Board of Directors and number of times attended by each Director and Audit &

Supervisory

Board Member (Attendance rate)

Attendance rate of Board of Directors Meetings in FY2024 (Period: April 1, 2024, to March 31, 2025)

- (Note)At the Ordinary General Meeting of Shareholders held on June 25, 2024, Mr. Tetsuya Kinose were newly appointed as an Audit & Supervisory Board Member.

Attendance rate of Audit & Supervisory Board in FY2024 (Period: April 1, 2024, to March 31, 2025)

- (Note)At the Ordinary General Meeting of Shareholders held on June 25, 2024, Mr. Tetsuya Kinose were newly appointed as an Audit & Supervisory Board Member.

Directors, Audit & Supervisory Board Members and Executive Managing Officers

As of June 26, 2025

Skill status

The Board of Directors believes that the officers are equipped with fundamental skills required for fulfilling their

roles of making decisions and supervising management as a team of Directors, including in relation to corporate

functions. Moreover, the highly-specialized skills currently possessed by officers and deemed necessary by the

Board of Directors in order to carry out the Transformative Value Evolution (TVE) Medium-term Management Plan

formulated in 2021, which has entered Wave2 from 2025, and to sustainably increase corporate value are as set out

below, and we believe that the Members of the Board of Directors form a team with the necessary talents to achieve

the above-mentioned objectives. Each skill and the status of its possession has been deliberated by the Remuneration

Committee and resolved by the Board of Directors.

- (Reference)Up to four of the main skills possessed by each officer are marked with a symbol (●).The skill matrix shown above presents items specifically expected of each of the officers, and does not present all of the knowledge and experience possessed by each of them.

We believe that officers possessing the following skills are equipped with particularly advanced and specialized skills for achieving the medium-term management plan and continuing to enhance our corporate value.

Executive Managing Officer

As of June 26, 2025

Criteria for Assessing Independence of Outside Directors/Audit &

Supervisory Board Members

The Company establishes following standards in order to ensure the independence of Outside Directors/Audit &

Supervisory Board Members.

- The person in question is not a current or former Executive1 of the Company or a related company (“Group

Companies”).

- Over the past 5 years a Close Relative2 of the person has not been an Executive1 of any Group Companies.

-

The following items are not currently applicable to the person and have not been applicable to the person in the

past 5 years:

- The person is a large shareholder of the Company (a person who directly or indirectly controls voting rights

worth 10% or more of total voting rights in the Company) or an Executive1 of such a large shareholder.

- The person directly or indirectly controls voting rights worth 10% or more of total voting rights in Group

Companies or is an Executive1 of such a large shareholder.

- The person is a Person for whom Group Companies are Important Clients3 or who is an Executive1 of such an

entity.

- The person is an Executive1 of an Important Client of Group Companies4.

- The person is an Executive1 of an Important Lender to Group Companies5.

- The person is affiliated with an auditing firm performing the Company’s statutory audits.

- The person is a consultant, an accounting professional or a legal professional (in the case that a group

such as a legal corporation or association is such a recipient, a person affiliated with that group) that has

received from Group Companies a large amount6 of money or other assets other than remuneration for directors

(and other officers).

- The person is a recipient of a large amount6 of donations or grants from Group Companies (in the case that a

group such as a legal corporation or association is such a recipient, a person affiliated with that group).

- The person is an Executive1 of a company to which Group Companies appoint Directors (regardless of whether

such Directors are executive or non-executive).

- None of the person’s Close Relatives are persons, regarding to whom Items (1) to (9) of paragraph 3 above

apply

(but limited to cases where such a Close Relative is an Important Person7 ).

- An Executive is defined as a person who is either a Director (excluding an Outside Director) of a company or

organization, an Executive Director, an Executive Officer, an employee who manages operations, a Senior General

Manager or other equivalent person or employee who manages operations.

- A Close Relative is defined as a dependent, a relative to the second degree or a cohabitating relative.

- A Person for whom Group Companies are Important Clients is defined as a person who has received 2% or more of

their consolidated annual gross revenues from Group Companies during that person’s most recent fiscal year.

- An Important Client of Group Companies is defined as a person who has paid 2% or more of the gross annual

consolidated revenues of Group Companies in the Company’s most recent fiscal year.

- An Important Lender to Group Companies is defined as a person who has provided finance to Group Companies that

represents an amount worth 2% or more of consolidated total assets as of the end of the Company’s most

recent

fiscal year.

- A large amount is defined as an annual average over the past five fiscal years of 10 million yen or more in the

case of an individual, or 2% or more of the consolidated net sales or total income of a group in the case where a

group such as a legal corporation or association is such a recipient.

- An Important Person is defined as a person who is either a Director, an Audit & Supervisory Board Member, an

Executive Officer and a General Manager or above.

Officer Compensation

The Company’s policy on compensation, etc., for Directors and Audit & Supervisory Board Members, or the

method of

calculating such amount, is designed so that compensation functions as an incentive for the sustainable growth of the

Group and the enhancement of corporate value over the medium to long term mainly for Directors, and the sharing of the

benefits and risks of the Company’s corporate value with shareholders are taken into consideration in the

system.

Specifically, it consists of monthly compensation (fixed), and bonuses and stock-based compensation (variable). The

amount of monetary compensation is within the limit for Directors as approved at the 71st Annual General Meeting of

Shareholders held on June 20, 2023 (within an annual amount of 280 million yen (of which is within an annual amount of

50 million yen for Outside Directors). However, this does not include employee salaries.) The number of Directors as

of the close of this Annual General Meeting of Shareholders is nine, including four Outside Directors. Bonuses are

paid upon resolution of the General Meeting of Shareholders following comprehensive consideration of annual corporate

performance, dividends, the level of employee bonuses, trends at other companies, medium to long-term performance, and

past payment results. The ratio of each type of compensation, etc., is approximately 2:1 “fixed” and

“variable (bonus

and stock-based compensation)” compensation respectively, with the ratio of variable compensation being higher

for

higher positions. As for Outside Directors, no bonus will be paid in consideration of their role. In order to ensure

Audit & Supervisory Board Member independence, the compensation system for Audit & Supervisory Board Member is

based

on monthly compensation only, without bonuses that are affected by company performance. The amount of monetary

compensation is within the limit for Audit & Supervisory Board Members as approved at the 58th Annual General

Meeting

of Shareholders held on June 25, 2010 (within an annual amount of 60 million yen). The number of Audit &

Supervisory

Board Members as of the close of this Annual General Meeting of Shareholders is four, including two Outside Audit

&

Supervisory Board Members. Compensation for Executive Managing Officers is based on employee salaries and

bonuses.

Method of determining policy for determining compensation, etc. of directors and Audit & Supervisory Board Members

is

to deliberate among a voluntary Personnel and Compensation Committee based on a survey of executive compensation

conducted by an external research organization, and to propose the results of deliberations to the Board of Directors

for resolution. The Remuneration Committee(convening eight times a year) consists of five Directors: Outside Director Mr. Yoshiaki Nagao as the chairperson, Representative Director & President Yuichiro Yamamoto, Representative Director Atsushi Komatsu, Outside Director Hidetaka Mihara, and Outside Director Sachiko Tsutsui, and a system is in place where Audit & Supervisory Board Member Naozumi Matsui may attend as an observer and express his opinion.

At the 66th Annual General Meeting of Shareholders held on June 22, 2018, the Company resolved that compensation for

the Company’s Directors (excluding Outside Directors and Non-Executive Directors. Hereinafter the same) be

linked to

the Company’s performance and stock value and, furthermore, a performance-linked stock compensation plan be

introduced

for the purpose of raising awareness among Directors to contribute to the improvement of medium to long-term business

performance and the increase of corporate value by sharing the benefits and risks of stock price fluctuations with

shareholders.

With respect to the performance-linked stock compensation plan, this is a system for Directors using the

Company’s

shares. The Company contributes money to a trust established by the Company, which is used to acquire shares and

deliver them to each Director. The number of shares to be delivered will be determined in accordance with the Share

Delivery Regulations established by the Company, and points will be calculated based on the degree of both individual

achievement and performance targets, and shares equivalent to the number of points will be delivered. In principle,

Directors receive the shares when they retire from their post. Provisions of the stock remuneration program contain

a provision stipulating that all of the points allotted may be rendered null and void and that no points may be allotted

thereafter (malus and claw-back provision). If any of the triggering requirements is met, the Company may apply this

provision pursuant to a resolution of the Board of Directors. The triggering requirements include resignation for personal

reasons, excluding cases where it is deemed unavoidable due to a business-related injury or illness, as well as dismissal

or resignation stemming from causing damage to the Company or committing any other act that is detrimental or

disadvantageous to the Company, such as an illegal act.

Total amount of compensation, etc., for Directors and Audit & Supervisory Board Members in FY2024

- (Note) 1The above number of persons and amount of compensation include one Director

who retired at the conclusion of the 72nd Annual General Meeting of Shareholders held on June 25, 2024.

- 2The breakdown of non-monetary compensation, etc., for Directors (excluding

Outside Directors) is 30 million yen in performance-linked compensation.

Evaluation of the Effectiveness of the Board of Directors

The Company conducts effectiveness analyses and evaluations of the Board of Directors to improve the function of the

Board of Directors and ultimately enhance corporate value.

The analysis and evaluation were conducted using the following methods, with evaluation and advice from outside

agencies.

1. Overview of the evaluation method for effectiveness

A questionnaire using an external organization was sent to all Director, Member of the Boards and auditors who are

members the Board of Directors meeting in March 2025. In order to ensure the anonymity of the subjects, this survey

was answered directly to an external organization. The Company analyzed, discussed, and evaluated the survey results

at the May 2025 Board of Directors meeting, based on the aggregate results reported by the external organizations.

2. Summary of the results of the effectiveness evaluation

According to the responses to the questionnaire and the results of the interviews, a certain degree of sufficiency

was evaluated with regard to the effectiveness the Board of Directors, and no major problems with the functioning the

Board of Directors were specifically identified. Therefore, the Company recognize that our Board of Directors is

generally functioning effectively.

Of the issues shared in the previous effectiveness evaluation, we confirmed that effective efforts are

being made to improve the following.

- Board discussions :

- ⇒We improved the quality of discussions by establishing regular pre-board

reporting sessions to follow up on the previous mid-term management plan and to review the new plan announced

in May. These efforts led to more active dialogue and improved evaluations.Oversight of human capital and intellectual

property also showed progress. However, the need for further improvement was acknowledged.

- Board monitoring :

- ⇒We made significant progress in securing diversity among key personnel.

At the same time, we recognized the need to strengthen oversight and monitoring functions across the entire group,

including overseas subsidiaries, through a review of both governance structure and operational practices.

In the future, based on this effectiveness evaluation, the Company will continue its efforts to enhance the

functioning the Board of Directors by promptly responding to issues after thorough consideration of them.

Internal Controls

In accordance with the Companies Act, the Board of Directors adopted a resolution on a “Basic Policy for

Internal

Control Systems” at a Board meeting in May 2006, and has reviewed it every fiscal year since then to establish

and

operate internal control systems based on the resolution. Please refer to Matters to be disclosed on the Internet in

connection with the Notice of Convocation of the 73rd Ordinary General Meeting of Shareholders.

Notice of the 73rd Annual General Meeting of Shareholders (Items to be omitted from deliverydocuments)

In addition, in accordance with the Financial Instruments and Exchange Act, in order to ensure the reliability of

financial reporting, we evaluate the effectiveness of development and operation of our internal control systems

regularly and work to strengthen and improve them. For the internal control reports, please refer to the Annual

Securities Report.

Annual Securities Report (73rd term)

The Purpose of TACHI-S

Our Group has more than 10,000 employees working in 53 locations in 9 countries worldwide. Based on the

“Purpose of

TACHI-S,” which is the pillar of our employees’ actions, we believe that each employee should think about

the meaning

of our corporate activities and their own work, and act voluntarily to contribute to the realization of a sustainable

society.

In order to achieve this, we promote activities to develop and spread the Purpose of TACHI-S’s existence on a

global

scale.

Corporate Philosophy